A Trailing Stop Loss (TSL) is a risk management tool designed to help protect gains when you are not actively monitoring your position.

Unlike a regular Stop Loss, which remains stationary, a TSL is an instruction to close a position at a rate that adjusts dynamically as the market price moves in your favour.

When you enable the TSL on a trade, the pip distance between the Stop Loss rate and the current market rate is locked in. As the market price moves in your favour, the Trailing Stop Loss also moves in the same direction, always maintaining the same pip distance from the market price.

However, if the market price moves against you, the TSL will not move, and the position will close if the Stop Loss rate is reached.

If the Stop Loss is manually edited while the TSL is already enabled, the pip distance between the new Stop Loss and the current market rate is updated. This new pip distance will be kept going forward instead of the old one.

Buy position

For a buy position, the TSL keeps the same locked-in pip distance from the current market rate below the market price.

If the market price rises, the TSL rises too. If the market falls, the TSL does not move, and the position will close if the Stop Loss rate is reached.

Below is a visual representation of how the TSL automatically adjusts on a buy position as the asset's price fluctuates. The solid line represents the asset price, and the dotted line represents the Stop Loss rate with TSL enabled.

Short position

For a short position, the TSL keeps the same locked-in pip distance from the current market rate above the market price.

If the market price falls, the TSL falls too. If the market rises, the TSL does not move, and the position will close if the Stop Loss rate is reached.

Example

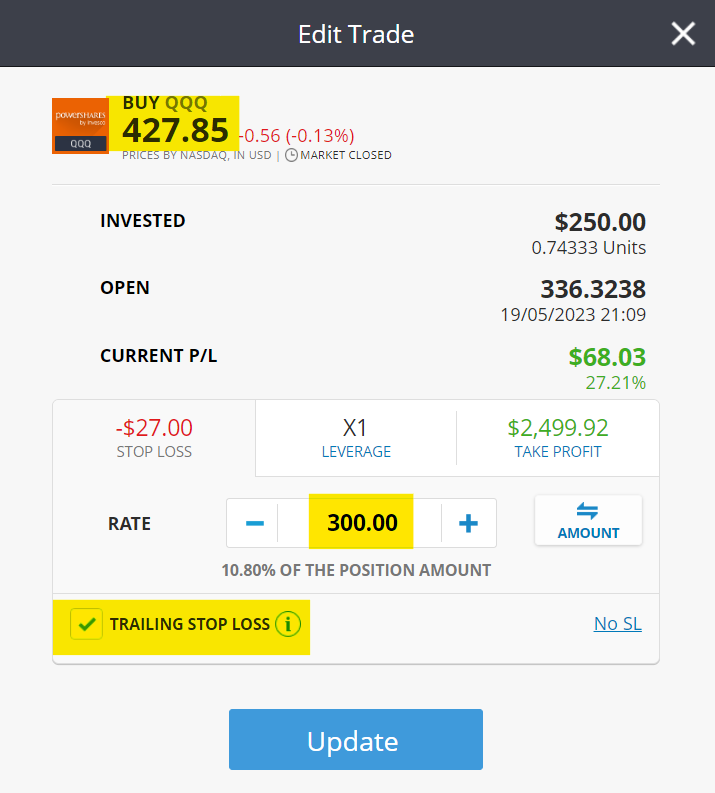

In the position below, the current market rate is 427.85. The investor sets a Stop Loss rate of 300.00 and activates Trailing Stop Loss.

The difference between the current market rate (427.85) and the Stop Loss rate (300.00) is 127.85 (12,785 pips). This pip distance is now locked in. So, let's say the asset's price increases to 527.85, then the Stop Loss would automatically adjust to 400.00. However, if the price decreases the Stop Loss will not adjust.